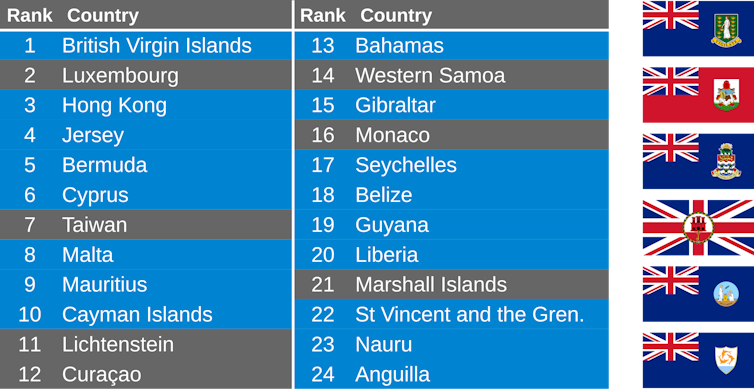

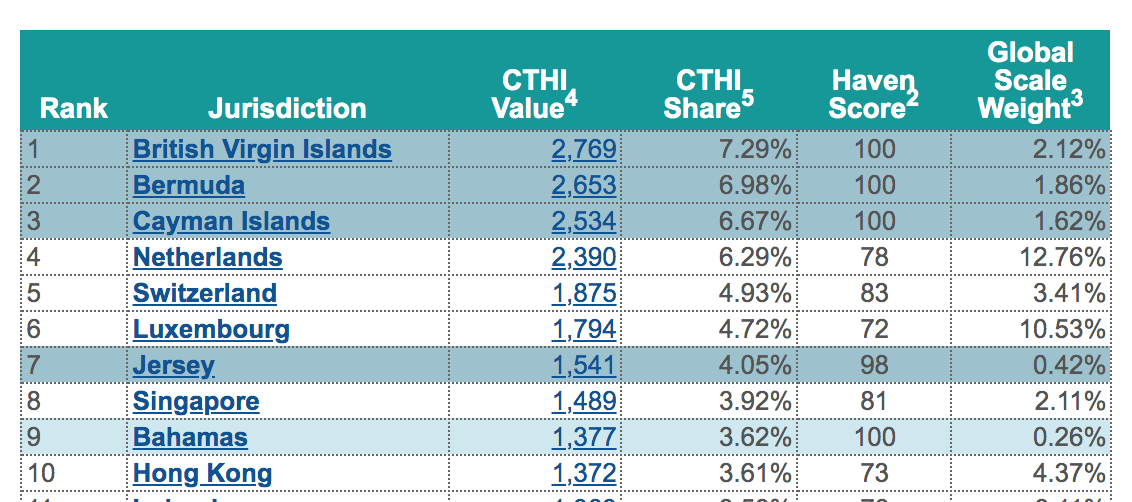

Transparency International - Tax Justice Network released their Corporate Tax Haven Index, that ranks countries by their complicity in global corporate tax havenry. The Top 10 jurisdictions alone are responsible for 52%

These Ten Worst Corporate Tax Havens in the World Are Stifling Sustainable Development - UN Dispatch